How much money do you need for the rest of your life?

Research shows that the majority of people have no idea how much money they will need for the rest of their life. You may have income, assets and investments but no idea what it all means, or what kind of financial future awaits you.

If you feel like this, you’re not alone!

The question “how much is enough?” is one we’re regularly asked by our clients. It’s our job to help you gain answers.

That’s why we’ve teamed up with Paul Armson, author of the hugely popular financial planning classic, “Enough: How much money do you need for the rest of your life?” to offer free downloadable copies of the book to our clients and visitors to our website. It’s completely free and comes with no obligation to proceed further with our services.

This book reflects very clearly and simply, in an easy-to-read format, how our financial planning process works, what the benefits are to the approach we follow, and how it will empower you to take control of your own financial future.

Reading the book will help you:

- Understand the concept of “your number” – how much you’ll need to live your life to the full

- Calculate what your number is

- Envision what’s possible in your life

- Gain clarity on your financial future

- Empower yourself and take control of your future

- Understand how working with a lifestyle financial planner such as Berry & Oak can help you gain the most from life and achieve your aspirations

Download your free book

If reading the book prompts you to look for more personalised help with your finances, or you’d simply like more information on how we can help you build and protect your wealth so that you can gain financial security, then please do contact us. We’d be very happy to answer your questions.

Truth About Money

Try out cash flow modelling for yourself with our free “Truth About Money” tool.

What is Truth About Money and what does it do?

Truth About Money is a consumer cash flow modelling tool that we have provided access to, free of charge. It shows part of what we do in our bespoke financial planning process.

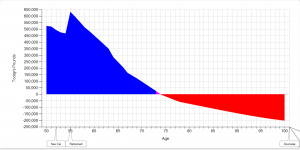

The tool will ask you questions about what you earn, spend, save, own, and owe. It then uses government statistical rates and generic assumptions to produce an estimated cashflow forecast chart based on the values you input.

Once the cashflow has been produced, you can play around with assumptions. So, for example, you can see what would happen to your cash flow in the future if you spent less per month or earned more.

We provide access to Truth About Money because we believe it is a useful tool that can help you understand your finances and assist you in visualising what your financial future could look like.

What is the difference between Truth About Money and the full financial planning software we follow?

Truth About Money uses general assumptions and statistical rates instead of asking for details such as start/end dates, interest rates and how you intend to crystallise any pensions, for example. The cash flow that results from this is, therefore, generic.

The financial planning we do with clients is much more than just generic cash flow modelling: it is comprehensive financial planning where all assumptions are tailored to your specific circumstances and goals. There are detailed tax breakdowns and it can simulate just about any scenario including the financial impact of a disability or death. It also allows us to stress test the model with, for example, market crash simulations. It is an extremely powerful tool used by qualified professionals that allows us to give responsible and accurate advice. We’d be happy to explain it in more detail if you’d like further information.

Ready to talk?

If you want to know more about getting the most out of your finances for your retirement, investing or estate planning, please get in touch. You can send us an email or use the direct message box at the bottom of this page. Or call us and we can chat through your needs and, if you are ready, make an appointment to better understand how we can help.