The cost of paying a mortgage has soared for many people over the last 12 months and, understandably, many households are worried.

In fact, according to a report in the Independent, half of mortgage holders said they are concerned about rising interest rates. Around a third of people said they were already finding it difficult to keep up with repayments.

With this in mind, understanding what affects your monthly repayments could help you choose a mortgage that’s right for you and reduce your outgoings if necessary.

Read on to find out how the interest rate and term of the mortgage affect your repayments, and what you could do to reduce your costs.

2 important factors that affect your mortgage costs

1. The interest rate

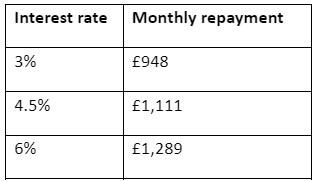

The interest rate you’re offered when applying for a mortgage has a direct effect on your monthly repayments.

The below table shows how the interest rate would affect your monthly repayments for a 25-year repayment mortgage if you borrowed £200,000.

Source: MoneySavingExpert

The good news is that interest rates appear to be stabilising.

According to statistics published by the BBC, the average interest rate for a two-year fixed deal at the start of February 2023 was 5.44% – after exceeding 6% since October 2022.

Many factors will affect the interest rate that a lender will offer you, including:

- How much of a risk they consider you

- Your other financial commitments

- How much equity you hold in your home.

Securing a mortgage deal that has a lower interest rate could cut your monthly outgoings and help you feel more confident about the future. However, don’t just focus on the interest rate, there may be other mortgage features that you need to weigh up too.

A mortgage broker can support you and find competitive deals that suit your needs. Working with a mortgage broker can be valuable and could help you reduce your mortgage repayments.

2. The mortgage term

The mortgage term is how long you’ll repay the mortgage.

Traditionally, first-time buyers have taken out a 25-year mortgage. However, as house prices have increased, so have mortgage terms. It’s now common to take out a mortgage for 35 or even 40 years.

A longer mortgage term will mean that your monthly repayments are lower, as they are more spread out. However, over the full term of the mortgage, it means you’ll pay more interest and it could significantly increase the total cost of borrowing.

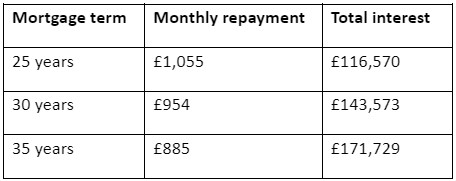

Let’s say you take out a repayment mortgage of £200,000 with an interest rate of 4%. The table below shows how changing the mortgage term could affect your costs.

Source: MoneySavingExpert

When your mortgage deal ends, you can also review the term and make changes if you want to.

You don’t have to follow the timescale you set out when you first took out a mortgage. If you initially took out a 25-year mortgage with an initial 5-year deal, at the end of those five years, you could select another 25-year term assuming you meet the lender’s criteria.

Alternatively, if your financial position has improved, you may want to shorten the mortgage term to save money overall.

So, if you’re worried about how you’ll meet mortgage repayments now, choosing a longer term could be useful. But you should keep in mind that it could cost you far more when you review the total interest you’d pay.

Get in touch to talk about your mortgage

We can help you weigh up the different mortgage options and decide which one is right for you. We can also provide valuable support to find a deal with a competitive interest rate that suits your needs. Please contact us to arrange a meeting.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.