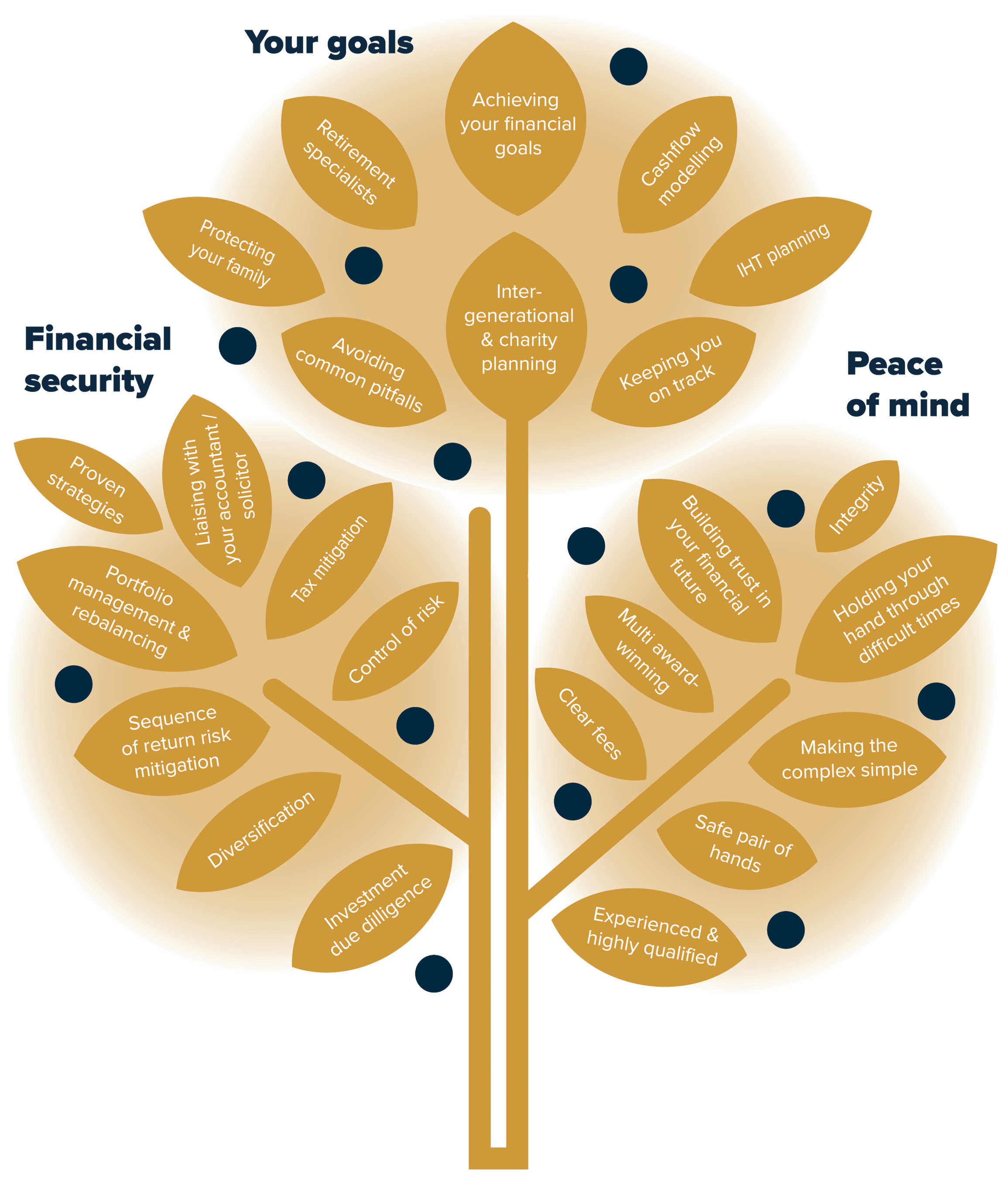

The Berry & Oak Value of Advice Tree

Click on the blue dots on each leaf to read further information.

Financial security

Sequence of return risk mitigation

Sequence of return is a risk that few investors are aware of. However, it could have a devastating impact on how long your pension fund lasts. Sequence of return” refers to the risk of suffering with poor returns in your early years of retirement, as you are more likely to deplete your savings over the course of your retirement. In other words, the danger of you running out of money grows. We can help you plan and take a few simple but effective steps to mitigate that risk – and give you a longer-lasting retirement income.

Investment due diligence

We conduct rigorous due diligence on all your investments, and comprehensively research all the funds and products that we use. With more than 9,000 instruments in the UK to choose from, we will save you time by analysing the options on your behalf. What’s more, you will gain peace of mind that you are invested in the most appropriate way for your circumstances, approach to risk and long-term goals.

Portfolio management and rebalancing

We use sophisticated modelling tools to help maximise your returns. For every client, we are seeking better potential performance with minimal possible risk. That’s the case, whatever your appetite for risk and risk tolerance. We ensure portfolios are kept up to date, by being extremely attentive to market changes, new product innovations and changes in legislation. Our goal is to ensure that your portfolio remains the most appropriate for your goals and your risk profile.

Diversification

Diversification can be neatly summarised as “not putting all your eggs in one basket”. A well-diversified portfolio can deliver the returns that you seek with a lesser amount of risk. We use sophisticated tools to help you achieve the returns you need, within the risk tolerance you have.

Tax mitigation

We will make sure that you are using all applicable tax reliefs and allowances each year. In doing so, we can ensure more of your money is available for you to put into your savings and investments for the future. Estimates suggest that investing more of the money you save through tax efficiencies could boost returns by 1% per year.

Control of risk

Risk is a complex subject with many dimensions. We will help you navigate, understand and mitigate risk, ensuring you feel secure in your decisions. You will benefit from our expertise and structured questions to guide you to solutions that meet your needs and objectives in a way that’s clear and understandable.

Liaising with your accountant / solicitor

Our experience of working with accountancy and solicitors’ practices gives us a great understanding of tax and legal matters – both personal and corporate. Having clear and shared goals is more effective and gives you peace of mind that all your professional advisers are on the same page.

Proven strategies

The Berry & Oak Approach™ has been recognised as providing both financial and emotional value for our clients. Our success has been recognised with many prestigious awards in a wide range of categories across financial planning, tax planning, client engagement, retirement planning and “best employer”. Even more importantly to us, we know our approach works because our clients tell us it does. We’re over the moon when we see our clients achieving their goals, making confident decisions and fulfilling their ambitions.

Your goals

Retirement specialists

When Pension Freedoms were introduced in 2015, they were initially trumpeted as offering a great choice for consumers. But, over time, it has become clear that planning and managing income from a pension pot that may have to last 35 years or more is far more complex than many thought. Understanding sequence risk and asset class returns vs inflation; establishing a sustainable withdrawal rate; managing life and health longevity; and planning cashflow over four decades is tricky stuff! And extremely important to get right. We’re here to help you understand your options and find the path that is right for you.

Intergenerational and charity planning

Student debt and rising house prices have put huge pressures on the next generation. It is little surprise therefore that parents and grandparents want to help. But what are the most effective and secure ways to make a difference? How do you gift but retain family control? What are the tax implications of gifts or house purchase? We can help with all these questions and more, and help you achieve confidence and value.

Keeping you on track

Managing the transition of wealth from one generation to the next is a complex area. We have many years’ experience in this area and work closely with other professionals where it aids our clients in achieving a streamlined approach. We will help simplify the issues and give you the long-term certainty and flexibility you seek.

Protecting your family

True peace of mind cannot be achieved until you know your loved ones are protected from the possible devastating financial impacts of sudden illness or death. We’ll help you to identify the possible risks you and your family may face and put protection in place to safeguard you, your assets and those you care about against potential threats to your financial wellbeing.

Avoiding common pitfalls

Sticking to a plan can be hard when markets are up or down. To further complicate things, we humans aren’t always the best at making decisions. In fact, research shows that investors may be losing up to 2% per year by falling into common traps. Our proven approach is designed to help you navigate the rough terrain and avoid the traps.

Inheritance Tax planning

Using trusts, wills, and other strategies, we can make sure your money ends up in the hands of the people you want, when you want. Without planning, up to 40% of your hard-earned savings or life assurance could be paid to the taxman. Inheritance Tax planning gives you confidence that your wishes are met, your loved ones financially protected and those you want to see benefit from your wealth, enabled to do so.

Please note – Wills and trusts are not regulated by the Financial Conduct Authority.

Achieving your financial goals

When Alice in Wonderland asks the Cheshire Cat, “Would you tell me, please, which way I ought to go from here?” the Cat replies, “That depends a good deal on where you want to get to”. It is the same for all of us – the first stage in achieving your long-term financial goals is to have clarity of what they are. This is a key area of our expertise, and we can help discuss, plan and agree a detailed and realistic plan for your financial future.

Cashflow modelling

It can be extremely hard (or impossible) to project returns, costs, inflation and your income needs in the future without expert help. We use powerful but simple tools that will illustrate this for you. Seeing a picture of your future “money in and out” can really put into perspective what you can comfortably afford to be spending and what you need to be putting aside.

Peace of Mind

Integrity

As a Chartered and Accredited Financial Planning Firm™, we are committed to upholding the highest professional standards. We abide by a strict Code of Ethics and as an independent firm, we can recommend products and providers from the entire market, without restriction. That means you will have access to the widest possible range of financial solutions, and you don’t need to worry about us facing any conflicts of interest or being incentivised to sell you any particular products from any particular provider.

Safe pair of hands

When it comes to your money, you want someone who knows what they’re doing. So, it’s good to know that we’re all professionally qualified, have many years’ experience and are committed to the highest professional standards. We take the time to get to know each and every one of our clients; what you want from life, what you enjoy doing and where you want to be. We really care and go that extra mile to provide an outstanding service.

Clear fees

When it comes to fees, we think the most important thing is that you know exactly what to expect and what you’ll get in return. We believe in being completely transparent about how we charge. That means there are no nasty, hidden surprises – just fees that reflect the work involved and the value we can add for you, laid out clearly, right at the start of the process.

Multi award-winning

We’re delighted to have won a large number of prestigious financial services awards across a wide range of categories including financial planning, tax planning, client engagement, retirement planning and “best employer”. The number and range of awards that we have won set us apart as one of the most highly awarded and successful financial planning firms in the country.

Please note – Tax planning is not regulated by the Financial Conduct Authority.

Experienced and highly qualified

Our team are highly experienced and exceptionally well-qualified: it’s something we insist on. We are one of a very small number of financial planning firms to hold both Chartered status from the Chartered Insurance Institute (CII), and Accredited Financial Planning Firm™ status from the Chartered Institute for Securities and Investments (CISI). These are considered the “gold standard” accreditations in financial planning and holding them both sets us apart as one of the most highly accredited financial planning firms in the UK.

We have many years’ experience dealing with the ups and downs of financial life and our focus on retirement planning, legacy planning and helping those who have received an inheritance means we’ve built up specialist knowledge and expertise we can pass on to our clients.

Holding your hand through difficult times

Divorce, death, illness, redundancy… you may face many stressful periods of time in your life. We are not just here to organise your finances; we’re here to support you through life’s ups and downs. We have a vast amount of experience and expertise in helping clients navigate difficult times, as well as a genuinely caring team who will treat you like family when it matters most.

Making the complex simple

While we are experienced and well qualified, we never forget whose money we are looking after. The simpler we can make your plan, the more able you are to make fully informed decisions that you are confident in, and the more likely you are to stick to the plan – a key measure of our success. We will also help reduce your paperwork burden by helping you understand what you need to file and what you can bin! We will manage application forms and service enquiries on your behalf and provide valuations and updates regularly so you can stay on top of things more easily.

Building trust in your financial future

Understanding your objectives allows us to be alert to opportunities – new products, new tax freedoms, better strategies – that will help you reach your goals more quickly or more efficiently. We are your eyes and ears in the ever-changing tax, legal and product markets. And we will keep you on track. Once we have established your risk profile, we manage and review your investments to make sure you stay on course. We will assess your risk profile regularly and the risk your portfolio is exposed to, to make sure they stay aligned.

Ready to talk?

If you want to know more about getting the most out of your finances for your retirement, investing or estate planning, please get in touch. You can send us an email or use the direct message box at the bottom of this page. Or call us and we can chat through your needs and, if you are ready, make an appointment to better understand how we can help.